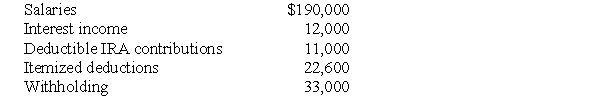

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2017.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax),rounded to the nearest dollar?

e.What is the amount of their tax due or (refund due)?

Definitions:

Fallopian Tubes

Pair of tubes along which eggs travel from the ovaries to the uterus in the female reproductive system.

Closed Adoptions

Adoption processes where there is no exchange of contact information and no contact between the biological and adoptive families after the adoption is finalized.

Chlamydia

A sexually transmitted bacterial infection.

Silent Epidemic

A health condition or disease that spreads widely or affects a large number of people without receiving significant public attention or awareness.

Q2: Individuals Rhett and Scarlet form Lady Corporation.Rhett

Q3: All of the following items are included

Q7: Passive activity loss limitations apply to S

Q11: Flow-through entities include partnerships,limited liability companies,limited liability

Q46: Billy,age 10,found an old baseball glove while

Q49: Atiqa receives a nonliquidating distribution of land

Q58: Kate can invest $4,000 of after-tax dollars

Q66: Margaret died on September 16,2017,when she owned

Q76: Funds borrowed and used to pay for

Q109: Under the accrual method of accounting,income is