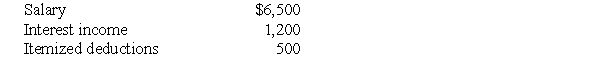

The following information for 2017 relates to Emma Grace,a single taxpayer,age 18:

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Definitions:

Franchise

A business model that allows individuals or entities to operate a store or outlet using the branding, products, and operational methods of an established company.

Franchisee

An individual or company that holds the rights to conduct business under an established brand or trade name in a specific territory.

Franchisor

A person or company that grants the license to third parties for the conducting of a business under their brand's name and operation model.

B-Corp Certification

A designation that a business meets high standards of verified social and environmental performance, public transparency, and legal accountability.

Q2: On July 1,Alexandra contributes business equipment (which

Q5: Under the tax concept of income,all realized

Q26: Jamahl has a 65% interest in a

Q86: Jack exchanged land with an adjusted basis

Q93: Because of the locked-in effect,high capital gains

Q104: George transferred land having a $170,000 FMV

Q106: Cheryl is claimed as a dependent on

Q110: One requirement for claiming a dependent as

Q119: Gain is recognized by an S corporation

Q122: Danielle transfers land with a $100,000 FMV