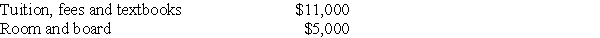

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2017:

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Out-of-the-money

A term used in options trading to describe an option that would not profit if exercised immediately, i.e., a call option with a strike price above the underlying asset's price or a put option below it.

In-the-money

An option is in-the-money when it has intrinsic value, meaning for a call option, the market price is above the strike price, and for a put option, below the strike price.

Black-Scholes Model

A mathematical model used for pricing European-style options and assessing the options' market value based on factors such as volatility, risk-free rate, and time to expiration.

Exercised

Refers to the act of implementing the rights granted by a financial contract, commonly in options trading where a buyer may execute the option.

Q11: Sari transferred an office building with a

Q26: Gifts of appreciated depreciable property may trigger

Q51: If an individual is an employee and

Q63: The phrase "Entered under Rule 155" indicates

Q69: Jared wants his daughter,Jacqueline,to learn about the

Q88: Sometimes taxpayers should structure a transaction to

Q99: Ordinary losses and separately stated deduction and

Q111: Which of the following statements with respect

Q125: All or part of gain realized on

Q141: A corporation may make an election to