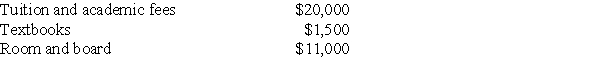

Burton and Kay are married,file a joint return with an AGI of $116,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2017:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Definitions:

Shading

The act of adding darkness to part of a drawing or diagram to indicate depth, form, or differentiation.

Copula

In logic and grammar, a word or expression that links the subject of a sentence to a predicate, such as "is" in "The sky is blue."

Quantifier

A symbol or word used in logic and mathematics to specify the quantity of subjects to which a statement applies.

Complete Proposition

A statement or assertion that conveys a complete thought or idea, typically containing a subject and predicate that make a declarative statement.

Q4: A taxpayer at risk for AMT should

Q19: If the majority of the partners do

Q19: According to the AICPA's Statements on Standards

Q48: A taxpayer may use the FIFO or

Q76: A tax case cannot be appealed when

Q78: If an exchange qualifies as a like-kind

Q83: When the House and Senate versions of

Q90: During the current year,George recognizes a $30,000

Q99: Ordinary losses and separately stated deduction and

Q138: When computing a corporation's alternative minimum taxable