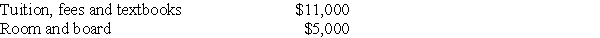

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2017:

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Q3: In the current year,Bosc Corporation has taxable

Q9: Where non-like-kind property other than cash is

Q15: Gains on sales or exchanges between a

Q38: Atiqa took out of service and sold

Q99: The building used in Terry's business was

Q100: Pursuant to a complete liquidation,Southern Electric Corporation

Q111: The Senate equivalent of the House Ways

Q116: If a principal residence is sold before

Q121: In order to avoid the imputation of

Q145: Nonrefundable tax credits<br>A) only offset a taxpayer's