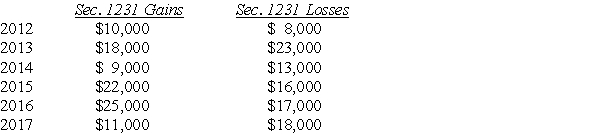

Lucy,a noncorporate taxpayer,experienced the following Sec.1231 gains and losses during the years 2012 through 2017.Her first disposition of a Sec.1231 asset occurred in 2012.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Definitions:

Modern US Hospitals

These are healthcare facilities in the United States that incorporate advanced medical technology, comprehensive services, and follow current healthcare practices to provide patient care.

Heart-Lung Machines

Medical devices that temporarily take over the functions of the heart and lungs during cardiac surgery.

Blood Transfusion

The medical process of receiving blood or blood products into one’s circulation intravenously, commonly used to replace lost components of the blood.

Q17: For tax purposes,the lower of cost or

Q29: Juan's business delivery truck is destroyed in

Q39: Johnson Corporation has $300,000 of AMTI before

Q48: Which of the following statements is false

Q89: In year 1 a contractor agrees to

Q96: Assume a taxpayer projects that his total

Q97: In year 1 a contractor agrees to

Q104: The books and records of Finton Corporation,an

Q121: New business owners expecting losses in the

Q143: By calculating its depreciation on personal property