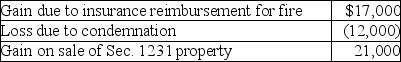

This year Pranav had the gains and losses noted below on property,plant and equipment used in his business.Each asset had been held longer than one year.

A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

Definitions:

Unreimbursed

Expenses that have not been paid back or compensated, especially reference to employee business expenses.

Tax-exempt

Not subject to tax by federal or local authorities, often applicable to certain income, property, or organizations.

Medical Expenses

Costs for healthcare services, treatments, prescriptions, and other medical needs that may be partially deductible on one's taxes.

Moving Expenses

Costs incurred for relocating for a new job or business location that were once deductible under certain conditions, but are now limited following recent tax law changes.

Q29: C corporations can choose between the cash-basis

Q33: The exchange of a partnership interest for

Q36: Carlotta,Inc.,has $50,000 foreign-source income and $150,000 worldwide

Q41: In computing the alternative minimum taxable income,no

Q53: This year,Hamilton,a local manufacturer of off-shore drilling

Q54: A couple has filed a joint tax

Q62: Sycamore Corporation's financial statements show the following

Q67: When the Tax Court follows the opinion

Q87: Tara transfers land with a $690,000 adjusted

Q112: Ron's building,which was used in his business,was