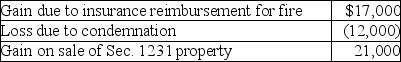

This year Pranav had the gains and losses noted below on property,plant and equipment used in his business.Each asset had been held longer than one year.

A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

Definitions:

Machine Hours

A measure of the total running time of machinery used in production over a specific period, often used to allocate costs based on machine usage.

Job Cost Sheets

Documents that track the materials, labor, and manufacturing overhead costs incurred for a specific job in a cost accounting system.

Job Order Costing

An accounting method used to track the costs associated with producing a specific batch of products or performing a specific job.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to individual units of production, based on a selected cost driver.

Q6: If a corporation's charitable contributions exceed the

Q16: If the U.S.District Court for Rhode Island,the

Q30: A corporation is classified as a personal

Q44: During the year,Jim incurs $500,000 of rehabilitation

Q56: Common AMT adjustments for corporations include all

Q76: A tax case cannot be appealed when

Q76: Depreciable property includes business,investment,and personal-use assets.

Q79: Mitchell and Debbie Dixon,a married couple,sell their

Q81: What is the minimum information that should

Q111: The Senate equivalent of the House Ways