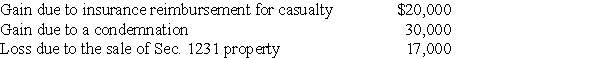

The following are gains and losses recognized in 2017 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

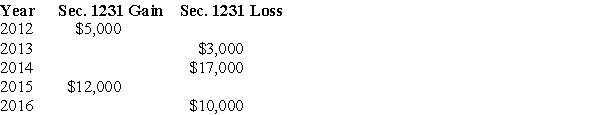

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Alfred Adler

A psychologist and founder of the school of individual psychology, who emphasized the importance of feelings of inferiority and the need for societal contribution as key drivers of behavior.

Subjective View

An opinion based on personal feelings, tastes, or opinions, rather than external facts or evidence.

Cognitive Approach

A psychological perspective that focuses on the mental processes involved in knowledge acquisition, perception, memory, and problem-solving.

Humanistic Approach

A perspective in psychology that emphasizes the study of the whole person and the uniqueness of each individual's experience.

Q2: An investor exchanges an office building located

Q6: Form 6251,Alternative Minimum Tax,must be filed in

Q18: A corporation pays AMT in the current

Q45: Any Section 179 deduction that is not

Q51: In April 2017,Emma acquired a machine for

Q53: An individual taxpayer who is self-employed and

Q62: AB Partnership earns $500,000 in the current

Q64: A taxpayer may use a combination of

Q76: Partnerships,S corporations,and personal service corporations may elect

Q90: For purposes of the AMT,the standard deduction,but