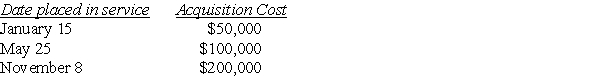

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2017 and does not use Sec.179.The property does not qualify for bonus depreciation.Mehmet places the property in service on the following schedule:

What is the total depreciation for 2016?

Definitions:

Corridor Principle

A theory suggesting that once entrepreneurs embark on a venture, they are likely to encounter unforeseen opportunities and paths that were not visible to them before starting the venture.

Logistics

The management of the flow of goods, information, and other resources between points of origin and consumption to meet customer requirements.

Fast-Growth Start-Ups

Young companies that experience rapid growth in terms of revenue and market size due to innovative products or services.

Startup

A company in the initial stages of operations, often characterized by innovations and fast growth, aiming to meet a marketplace need by developing or offering a new product or service.

Q3: Some of the factors that may cause

Q7: Tax strategies involving transfer pricing depend on

Q26: A prohibited subsidy,in the view of the

Q33: Why is overcapacity sometimes a negative condition

Q40: What is the primary benefit that a

Q46: The distribution of taxable income over time

Q48: Section 179 allows taxpayers to immediately expense

Q75: During the current year,Hugo sells equipment for

Q109: An accrual of a reserve for bad

Q115: Frank,a single person,sold his home this year.He