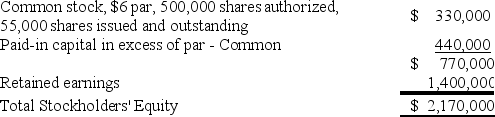

Gilligan Corporation was established on February 15,Year 1.Gilligan is authorized to issue 500,000 shares of $6.00 par value common stock.As of December 31,Year 3,Gilligan's stockholders' equity accounts report the following balances:

At the end of Year 3,Gilligan decides to issue a 5% stock dividend.At the time of issue,the market price of the stock was $22 per share.

At the end of Year 3,Gilligan decides to issue a 5% stock dividend.At the time of issue,the market price of the stock was $22 per share.

-What is the amount of retained earnings that will be transferred to paid-in capital as a result of the stock dividend issued by Gilligan Corporation?

Definitions:

Warrant Attached

An option issued by a company that gives the holder the right to purchase the company’s stock at a specific price before expiration.

Ex-rights

Denotes a security that is trading without the right to receive the most recently announced rights offering.

Additional Paid-in Capital

The amount of money investors have paid to a company above and beyond the par value of the shares they have purchased.

Cumulative Preferred Stock

A type of preferred stock where dividends accumulate if not paid in any given year, ensuring that dividends must be paid out to preferred stockholders before common stockholders receive any.

Q4: Which of the following shows the effect

Q8: Which of the following items would be

Q11: All of the following are considered to

Q29: What is the amount of cash outflow

Q39: Every currency quote contains two components:<br>A)the price

Q40: Gates,Inc.and Markham,Inc.each had the same financial position

Q47: When debt is used to finance the

Q47: An example of the widespread belief that

Q57: The current ratio is a measure of

Q99: The study of an individual financial statement