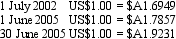

The net assets of a foreign operation at 30 June 2005 are constituted as assets of US$400,000 and liabilities of US$250,000.The parent entity purchased the foreign subsidiary on 1 July 2002.Exchange rate information is as follows:  The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

Definitions:

Q3: Jabba Ltd acquired a 70 per cent

Q5: If a subsidiary makes a dividend payment

Q26: The Australian Greenhouse Office has prepared several

Q29: When shares in a subsidiary are sold

Q34: The Parliamentary Joint Committee on Corporations and

Q35: On a 1 July 2006,Mayorga Ltd has

Q41: Companies that use accrual accounting recognize revenues

Q47: Which of the following statements is true

Q54: During Year 3,Fancy Foods Incorporated earned $54,000

Q80: What was the net cash flow from