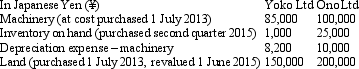

Lennon Ltd has two foreign operations based in Japan.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2015:  Exchange rate information is:

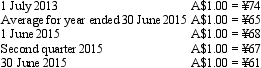

Exchange rate information is: The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000) :

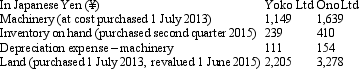

The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000) : Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?

Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?

Definitions:

Undervalued Inventory

Undervalued inventory occurs when the recorded cost of inventory is less than its current market value, potentially misstating a company's financial position.

Carrying Value

The book value of an asset or liability on a company's balance sheet, calculated as the original cost minus accumulated depreciation or amortization.

Fair Value

The amount one would obtain from the sale of an asset or the cost incurred to settle a liability in a smooth transaction involving market players on the date of valuation.

Gross Margin

The difference between revenue and cost of goods sold, divided by revenue, expressed as a percentage.

Q1: Richmond Ltd has the following potential ordinary

Q8: Jabba Ltd acquired a 70 per cent

Q9: A jointly controlled entity:<br>A) Should be accounted

Q31: Where a parent entity with a controlling

Q34: When a parent sells its interest in

Q44: Which resource providers lend financial resources to

Q44: The essential feature of a non-monetary item

Q65: Ballard Company reported assets of $500 and

Q72: If a company uses the FIFO cost

Q93: Robertson Company paid $1,850 cash for rent