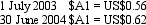

On 1 July 2003 Kanga Consultants Ltd completes a contract to provide advice on the installation of a networked computer system to a company in the US.The client pays the fee of US$500,000 into Kanga Consultants' US bank account on that date.The bank pays interest of 8 per cent annually on 30 June.The exchange rate information is:  What journal entries are required in Kanga Consultants Ltd's books for 1 July 2003 and 30 June 2004 in accordance with AASB 1012 (rounded to the nearest whole $A) ?

What journal entries are required in Kanga Consultants Ltd's books for 1 July 2003 and 30 June 2004 in accordance with AASB 1012 (rounded to the nearest whole $A) ?

Definitions:

Radios

Electronic devices for receiving radio waves and converting them into sound or other signals.

England

A country that is part of the United Kingdom, known for its rich history, cultural heritage, and as a pioneer of the industrial revolution.

Radio

A technology that uses radio waves to carry information, such as sound, by systematically modulating properties of electromagnetic energy waves transmitted through space.

Comparative Advantage

The ability of an individual or economy to produce goods or services at a lower opportunity cost than others, which forms the basis for trade.

Q6: For a cash flow hedge relating to

Q9: Tennant Creek Ltd has following transactions during

Q11: AASB 131 provides the choice between equity

Q11: When consolidating financial statements of foreign operations,we

Q18: Under the step-by-step method,the need to revalue

Q44: AASB 127 "Consolidated and Separate Financial Statements"

Q52: Retained earnings reduces a company's commitment to

Q52: On January 1,Year 1,Melon Moving Company paid

Q57: Merchandising businesses include retail companies and manufacturing

Q66: 'Significant influence' normally stems from the investor's