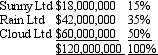

Sunny Ltd,Rain Ltd and Cloud Ltd contractually form a jointly controlled operation on 1 July 2005.The three companies agree to contribute the following amounts of capital to the venture in the same proportion as their rights to the assets and outputs:  The funds are used on 1 July 2005 to purchase land for a mining site for $65 million and machinery and equipment for $25 million.The balance of $30 million will be called on by the joint venture manager as required.Sunny Ltd and Cloud Ltd borrowed $10 million and $30 million respectively to finance their contributions to the joint venture.

The funds are used on 1 July 2005 to purchase land for a mining site for $65 million and machinery and equipment for $25 million.The balance of $30 million will be called on by the joint venture manager as required.Sunny Ltd and Cloud Ltd borrowed $10 million and $30 million respectively to finance their contributions to the joint venture.

The following information relates to the year ending 30 June 2006:

Total cost of production $15 million.These costs have been deferred in order to amortise them as production commences.

Of the total costs of production all but $3 million has been paid in cash.

The joint venture manager called on the venturers to contribute a further $20 million in total with each venturer contributing the appropriate portion according to their share in the joint venture (provided above) .

What entries would be required to record the formation of the joint venture and the transactions for the year ended 30 June 2006?

Definitions:

Bond Yields

The return an investor realizes on a bond, calculated as the coupon payments received from the bond relative to its price or face value.

Bullish Signals

Indications in the financial markets suggesting that the prices of securities are likely to rise.

Frequent Trading

A strategy involving the high turnover of portfolio assets, aiming to capitalize on short-term market movements.

Frequent Trading

The practice of buying and selling securities or other financial instruments within the same trading day, often seeking to capitalize on small price movements.

Q1: In the process of consolidating the translated

Q1: Richmond Ltd has the following potential ordinary

Q3: AASB 124 "Related Party Disclosures",requires relationships between

Q12: In the process of consolidating the translated

Q21: A payment to an employee in settlement

Q25: Under which of the following situations would

Q39: As prescribed in AASB 121,in translating the

Q42: Chestnut,Inc.reported the following balances on its balance

Q57: Where the entity's primary format for reporting

Q71: Which of the following is not one