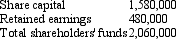

Mop Ltd acquired a 40 per cent interest in Bucket Ltd on 1 July 2004 for a cash consideration of $824,000.Bucket Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows:  Additional information relating to the period ended 30 June 2005:

Additional information relating to the period ended 30 June 2005:

Bucket Ltd had an after-tax profit of $665,000.

Bucket Ltd proposed a dividend out of pre-acquisition profits of $90,000.

Later in the period Bucket Ltd paid the $90,000 dividend and declared a further $100,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Mop Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Mop's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

Definitions:

Terminal Lung Cancer

A stage of lung cancer that is advanced and considered incurable, often characterized by a life expectancy of months.

Myocardial Infarction (MI)

A medical term for a heart attack, it occurs when blood flow to a part of the heart is blocked for a long enough time that part of the heart muscle is damaged or dies.

Dementia

A wide range of neurological disorders characterized by a persistent and typically progressive decline in cognitive function and memory, impacting everyday activities.

Arthroscopic Surgery

A minimally invasive surgical procedure used to diagnose and treat issues within joints through small incisions using an arthroscope.

Q1: After the auditor has signed the audit

Q4: Which of the following statement(s)is/are correct?<br>A) A

Q16: An associate is an investee over which

Q18: Under the step-by-step method,the need to revalue

Q33: The profit or loss on the sale

Q36: The qualitative characteristics identified in the Global

Q49: AASB 110 requires that adjusting events that

Q50: Safety Ltd purchased goods for £20,000 from

Q51: On 1 July 2012,Carol Ltd acquires all

Q51: Garrison Company acquired $23,000 by issuing