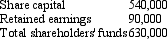

Jay Ltd acquired a 25 per cent interest in Low Ltd on 1 July 2003 for a cash consideration of $177,500.Low Ltd's equity at the time of purchase was as follows:  Additional information:

Additional information:

On 1 July 2003 Low's plant and equipment had a carrying value of $120,000 but a fair value of $140,000.The remaining expected useful life of the plant and equipment at this date was 10 years.Low did not revalue the plant and equipment in its books.

For the period ending 30 June 2004 Low Ltd recorded an after-tax profit of $70,000 out of which dividends of $30,000 were proposed in the 2003/2004 period and paid in the 2004/2005 period.

For the year ended 30 June 2005 Low Ltd had an after-tax profit of $90,000 out of which it provided for a dividend of $40,000,which has not been paid.

Jay Ltd does not accrue the dividends of associates as revenue when they are proposed.The investment has been recorded in Jay's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

Definitions:

Shareholders

Individuals or entities that own one or more shares of stock in a joint-stock company, giving them a right to a portion of the company's profits and a vote in certain company matters.

Quo Warranto

A legal proceeding used to challenge an individual's right to hold a public or corporate office.

De Facto Corporation

A corporation in existence by operations and public dealings, despite not completing the formal requirements.

Corporate Entity

A legal entity that is separate and distinct from its owners, which can own assets, incur liabilities, and conduct business.

Q2: AASB 3 specifies that where a parent

Q22: Gollum Ltd provides the following segment information:

Q29: After eliminating the dividend payable to the

Q29: The liquidators of an entity are considered

Q36: If the exchange rate for US dollars

Q42: A defined benefit plan is one in

Q56: Requirements regarding after-reporting-date-events are contained in AASB

Q57: Dixie Ltd acquired a 20 per cent

Q58: Tests to indicate whether significant influence exits

Q84: Tandem Company borrowed $32,000 of cash from