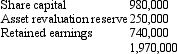

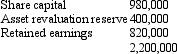

Window Ltd acquired a 70 per cent interest in Door Ltd on 1 July 2003 for a cash consideration of $1,399,000.At that date fair value of the net assets of Door Ltd were represented by:  On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by:

On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by: Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

Definitions:

Fixed Manufacturing Overhead

Costs that do not vary with the level of production output, including rent, salaries of permanent staff, and depreciation of factory equipment.

Production Volume

The total quantity of goods or products that a factory or production system can produce over a specific period.

Sales Volume

Refers to the total number of units sold within a given period.

Absorption Costing

An accounting method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Q8: What was the amount of liabilities on

Q10: The value of inventory on hand for

Q12: For the purpose of calculating earnings per

Q16: When a superannuation fund has inventories recognised

Q18: AASB 8 bans the disclosure of segments

Q19: In calculating the proportion of a subsidiary's

Q24: The carrying value of an asset is

Q25: Minority interests are defined is AASB 127

Q44: Sales on account decrease the balance in

Q60: Do-it-Yourself Defined Contribution Plan owns the following