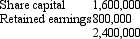

Mickey Ltd acquired a 70 per cent interest in Mouse Ltd on 1 July 2003 for a cash consideration of $1,700,000.At that date the shareholders' funds of Mouse Ltd were:  The assets of Mouse Ltd were recorded at fair value at the time of the purchase.

The assets of Mouse Ltd were recorded at fair value at the time of the purchase.

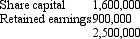

On 1 July 2005 Mickey Ltd purchased a further 20 per cent of the issued capital of Mouse Ltd for a cash consideration of $530,000.At this date the fair value of the net assets of Mouse Ltd were represented by: Impairment of goodwill was assessed at $9,000; of which $5,000 relates to the current period.There were no intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary and account for goodwill for the period ended 30 June 2006?

Impairment of goodwill was assessed at $9,000; of which $5,000 relates to the current period.There were no intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary and account for goodwill for the period ended 30 June 2006?

Definitions:

Culturally Sensitive Therapy

A therapeutic approach that is aware of, respects, and incorporates an individual's cultural background, beliefs, and practices in the treatment process.

Minority Identity

Refers to the sense of self that is influenced by belonging to a social group that is marginalized or discriminated against.

Maladaptive Attitudes

Negative thinking patterns that can lead to distress or dysfunctional behavior, often at the core of psychological disorders.

Negative Thoughts

Involuntary, often pessimistic assessments that can impact mood and behavior.

Q2: AASB 3 specifies that where a parent

Q8: Large Company owns 80 per cent of

Q15: The following information relates to Aragorn Ltd

Q17: Examples of monetary items that may be

Q17: In preparing consolidated financial statements minority interests

Q17: In accordance with AASB 8"Operating Segments",which of

Q22: Under the step-by-step method,the aggregate costs of

Q33: AASB 127 "Consolidated and Separate Financial Statements"

Q43: Which of the following is not a

Q54: A business segment is defined by AASB