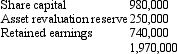

Window Ltd acquired a 70 per cent interest in Door Ltd on 1 July 2003 for a cash consideration of $1,399,000.At that date fair value of the net assets of Door Ltd were represented by:  On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by:

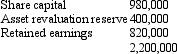

On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by: Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

Definitions:

Automatically Terminated

Describes a legal status or condition that ends without the need for any action by a party due to pre-set conditions being met.

Agency Relationship

A legal arrangement where one party, the agent, is authorized to act on behalf of another, the principal, in business transactions.

Principal

A person or entity who authorizes an agent to act on their behalf in dealings with third parties.

Constructive Trust

A legal remedy imposed by a court to address unjust enrichment or fraud, requiring the person holding the assets to transfer them to the intended party.

Q11: One of the steps in preparing consolidated

Q17: Dormant Ltd has a net income after

Q21: Once control over a subsidiary has been

Q23: AASB 131,'Interests in joint ventures' specifies how

Q25: Reasons for the requirement to disclose related-party

Q29: The period covered by AASB 110 "Events

Q34: Finger Ltd purchased 75 per cent of

Q38: AASB 124 defines control as:<br>A) The exercise

Q39: The calculation of the theoretical ex-rights price

Q60: Wattle Ltd is in the process of