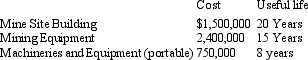

On 1 April 2008,Ulladulla Mining Ltd assessed that its Mollymook area of interest contained economically recoverable reserves of 50,000 ounces of gold.On the same day the entity installed the following assets:  The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

What is the total depreciation/amortisation expense for the capitalised development costs for the year ending 30 June 2008?

Definitions:

Management Rights

The rights retained by employers, allowing them to operate and manage their business without interference from the workforce.

Co-ownership

The state or condition where two or more parties hold property jointly, sharing rights and responsibilities.

Instrumentality

A term referring to a means or agency through which a function of another entity is accomplished.

Business Transaction

An interaction between two or more parties that involves the exchange of goods, services, or information for the purpose of conducting business.

Q2: Under AASB 127:<br>A) Management may agree with

Q13: The AASB 112 approach has been adopted

Q13: A key characteristic of a financial instrument

Q19: As a residual interest,equity ranks after liabilities

Q23: On 1 April 2008,Ulladulla Mining Ltd assessed

Q24: A non-current asset was sold by Subsidiary

Q38: Meat Ltd purchased 100 per cent of

Q40: Awake Ltd has a net income after

Q54: A business segment is defined by AASB

Q61: Minority interests (minority interests)are defined as the