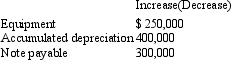

Swans Machinery Ltd reported a net profit of $3,000,000 for the year ended 30 June 2009.The following changes occurred in the balance sheet:  Additional information:

Additional information:

During the year Swans Ltd sold equipment with a cost of $250,000 and had accumulated depreciation of $120,000 for a gain of $50,000.

On 30 June 2009 Swans Ltd purchased equipment costing $500,000 with $200,000 in cash and a note payable for $300,000.

Depreciation expense for the year was $520,000

What is the amount of net cash from operating activities and net cash used in investing activities,respectively for the year ended 30 June 2009?

Definitions:

Natural Killer Cells

A type of lymphocyte (white blood cell) that plays a crucial role in the body's innate immune response by targeting tumor cells and virus-infected cells.

Target Cancer Cells

The practice of directing cancer treatments towards specific cancer cells, often to reduce damage to normal cells and improve treatment efficacy.

Macrophages

A type of white blood cell that engulfs and digests cellular debris, foreign substances, microbes, cancer cells, and anything else that does not have the types of proteins specific to healthy body cells on its surface.

Lymphokines

A type of cytokine secreted by T cells that increases T-cell production and directly kills cells with antigens.

Q10: Tissues Ltd has a depreciable asset that

Q19: Which of the following statements is not

Q28: The assets of a superannuation fund include:<br>A)

Q28: According to AASB 133 the number of

Q29: The liquidators of an entity are considered

Q36: Prepayments are:<br>A. Not financial instruments because they

Q40: AAS 25 "Financial Reporting by Superannuation Plans"

Q40: Under AASB 101 additional line items,headings and

Q53: Which of the following statements about post-acquisition

Q55: There have been numerous criticisms of AASB