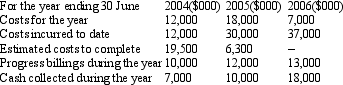

Russell Ltd commenced the construction of a bridge on 1July 2003.It has a fixed-price contract for total revenues of $35million.The expected completion date is 30 June 2006.The expected total cost to Russell Ltd at the beginning of the project is $29 million.The following information relates only to the construction of the bridge:  Russell Ltd uses the percentage of completion method based on cost to account for its construction contracts.What is the gross profit to be recognised in each of the 3 years (rounded to the nearest $000) ?

Russell Ltd uses the percentage of completion method based on cost to account for its construction contracts.What is the gross profit to be recognised in each of the 3 years (rounded to the nearest $000) ?

Definitions:

Absorption Costing

An accounting method that integrates all costs associated with manufacturing, from direct materials and labor to variable and fixed overheads, into the final cost of a product.

Variable Costing

A costing method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in the cost of goods sold, excluding fixed overhead.

Operating Income

The profit realized from a business's operations after deducting operating expenses such as wages, depreciation, and cost of goods sold.

Segment Margin

The amount of profit or loss generated by a particular segment of a business after accounting for the direct and indirect costs associated with that segment.

Q3: AASB 1023's disclosure requirements relating to the

Q4: The maximum period a defined benefit plan

Q10: Which of the following is not within

Q14: AASB 6 requires the separate disclosure of:<br>A)

Q40: A cash flow statement is a forecast

Q45: Manuka Ltd has seven employees who are

Q46: Non-deductible expenses results to a deferred tax

Q47: Measuring the value of heritage assets to

Q48: All things being equal,firms would typically prefer

Q49: AASB 2 requires all equity-settled share-based payment