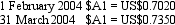

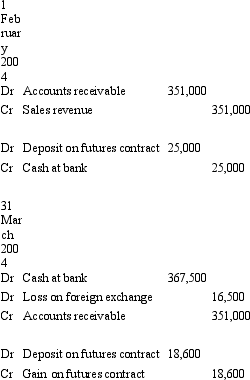

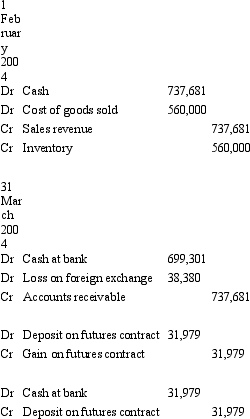

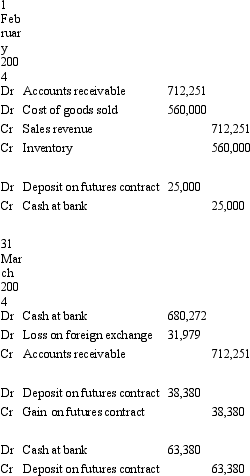

Jackson Ltd has a US$50,000 receivable due at the end of March 2004 for the sale of a specialised piece of hydraulic equipment.The sale was made on 1 February 2004 and the equipment cost Jackson Ltd $560,000 to manufacture.In order to hedge the receivable,Jackson Ltd enters into a futures contract on that date to sell five US dollar futures contracts.Each contract is for an amount of US$100,000 and the market rate for each futures contract is $A1 = US$0.6778 on 1 February.Jackson pays a deposit of $25,000 on the contracts.The futures contracts are settled on 31 March 2004,when the debtor pays off the receivable.The spot exchange rates during the period were:

The market rate for the futures contracts is $A1 = US$0.7150 on 31 March 2004.What are the entries to record the sale,futures contracts,receipt of payment and the settling of the futures contracts (rounded to the nearest dollar)?

The market rate for the futures contracts is $A1 = US$0.7150 on 31 March 2004.What are the entries to record the sale,futures contracts,receipt of payment and the settling of the futures contracts (rounded to the nearest dollar)?

A.

B.

C.

D.

E. None of the given answers.

Definitions:

Expression

A combination of symbols that represent a quantity or a relationship between quantities, often including variables and constants.

Z

In statistics, \(Z\) often represents the z-score, a measure of how many standard deviations an element is from the mean.

Simplify

Reduction of expressions or equations to their simplest form by performing available operations.

Expression

A combination of numbers, variables, and operations that together represent a particular value.

Q1: Extractor Ltd has carried forward costs of

Q22: Entity A contributes to a defined benefit

Q31: The transfer of tax losses to other

Q34: Cobalt Ltd owns an item of machinery

Q39: Research of market potential prior to the

Q42: Russell Ltd commenced the construction of a

Q43: Since the late 1980s,an increasing number of

Q48: When the carrying amount of an asset

Q54: A deductible temporary difference is one that

Q58: There are only rare occasions when an