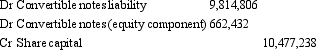

The following journal entry pertains to convertible notes with a face value of $10 million:

Which of the following statements are correct?

Which of the following statements are correct?

A. The instrument was over-valued when it was initially recognised.

B. The convertible note has been converted.

C. The value of the option to convert has increased over the period from initial recognition to conversion, by $477,238.

D. The instrument was over-valued when it was initially recognised and the value of the option to convert has increased over the period from initial recognition to conversion, by $477,238.

E. The instrument was over-valued when it was initially recognised and the convertible note has been converted.

Definitions:

Maturity Date

The specified date on which the principal amount of a bond, loan, or other financial instrument is due to be paid in full.

Maturity Value

The amount payable to the investor at the end of a debt instrument's life, including principal and any remaining interest.

Interest

The cost of using borrowed money or the return on invested funds, typically expressed as an annual percentage of the principal.

Purchased Equipment

Fixed assets bought for operational purposes, such as machinery or office fixtures.

Q4: Financial instruments have recently been developed and

Q10: Broadbeach Ltd is a manufacturing company with

Q10: On 1 July 2009 Lancashire Ltd grants

Q14: The central accounting issue associated with leases

Q32: Preference shares are often considered to be

Q35: Kensington Ltd is an importer and retailer

Q45: Which of the following share issue costs

Q56: The income statement satisfies the requirements of

Q57: Which of AASB 1023's requirements has received

Q58: Under AASB 101 something may be classified