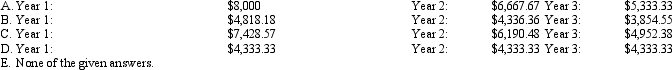

Hugo Ltd has acquired a machine for $26,000 and it cost a further $2,000 to install and set up the machine for operation.It is expected to operate within normal parameters for 6 years.It will be technologically obsolete in 10 years.The expected salvage values are $1,500 after 10 years and $2,000 after 6 years.The benefits to be derived from the machine are expected to be greater in the early years of its life.What depreciation should be charged in each of the first 2 years of the equipment's life using sum-of-digits depreciation?

Definitions:

U.S. Currency Value

The worth or purchasing power of the United States dollar in domestic and international markets.

Saudi Arabian Riyals

The official currency of Saudi Arabia, used for all financial transactions within the country.

U.S. Dollars

The official currency of the United States, commonly represented by the symbol $.

Return on Investment

A performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments.

Q1: Relevance and reliability characteristics are placed as

Q13: Accounting cannot be considered to be "culture

Q13: The audit of the financial reports of

Q20: Some research has shown that being in

Q34: Heritage assets have characteristics that create doubt

Q35: The predictions of PAT formulated by Watts

Q43: Diversification is the inclusion of a number

Q45: James Cook Ltd bought a piece of

Q46: Parker (1996)has identified a number of quantitative

Q89: Current price information is found in which