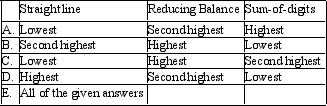

The company has a depreciable asset with a purchase price of $500,000 and an estimated residual of $20,000.The company estimates that the asset will generate future economic benefits for the next 10 years.You are not sure on what depreciation method to adopt but would like to be aware of the effect of using different depreciation methods.Which of the following is correct with respect depreciation expense for Year 1?

Definitions:

Cost of Goods Sold

The immediate expenses related to the manufacture of products sold by a business, encompassing both materials and workforce.

Perpetual System

An inventory management method that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

FIFO Perpetual

An inventory management system where the first items purchased (First-In) are the first to be sold or used (First-Out), continuously updated.

Cost of Goods Sold

The total cost directly tied to the production of the goods sold by a company, including materials and labor.

Q14: The central accounting issue associated with leases

Q15: Creative accounting violates IFRS standards and generally

Q19: Theorists' own values or ideological predispositions may

Q28: Recoverable amount of an asset is defined

Q32: A guaranteed residual value is that part

Q46: The Dow Jones Industrial Average (DJIA)consists of

Q48: A reporting entity must have legal ownership

Q50: The following journal entry accounts for one

Q52: Where the entity presents current assets separately

Q76: Last week, Seward Company stock was selling