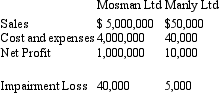

Consider the following information:

You are an accountant for both firms and would like to determine whether the impairment loss is material or not.Which of the following statement(s)is/are correct?

You are an accountant for both firms and would like to determine whether the impairment loss is material or not.Which of the following statement(s)is/are correct?

1.The impairment loss for both firms is material.

2.The impairment loss for Manly Ltd is material.

3.The impairment loss for Mosman Ltd is material.

4.The impairment loss for both firms is immaterial.

5.None of the given answers.

Definitions:

Social Security

A government program that provides financial assistance to people with an inadequate or no income.

Medicare Taxes

Federal taxes collected from earnings to fund the Medicare program, which provides healthcare benefits to senior citizens.

Medicare Withholding

A portion of an employee's wages that is deducted and sent to the government to contribute to the Medicare program.

Social Security Withholding

A mandatory process where employers deduct part of an employee's salary to contribute towards the United States Social Security program, aimed at providing benefits for retirees, disabled workers, and survivors.

Q3: AASB 138 prohibits the recognition of intangible

Q10: The general aim of the current-cost accounting

Q36: A combination of well-designed management compensation contracts,the

Q38: AASB 102 requires that the specific identification

Q48: Far-flung Co Ltd purchases Local Co Ltd

Q55: Which of the following are within the

Q66: David has purchased an investment that he

Q68: The documents signed when a customer opens

Q79: Assume that $100 is deposited at the

Q107: A report describing the transactions in an