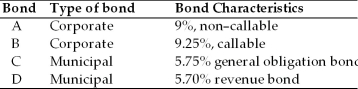

Martin is trying to decide which one of the following bonds he should purchase.All the bonds have the same maturity date and all have approximately the same level of risk.The general level of interest rates is declining.Martin is in the 33 percent federal income tax bracket and the 8 percent state income tax bracket.The municipal bonds are from his home state.

Which bond should Martin purchase if he wishes to hold it for the long term?

Definitions:

Early Treatments

Interventions or medicines applied at the initial stages of a disease or condition intended to cure, alleviate, or prevent the development of further complications.

Middle Ages

A historical period in Europe, roughly from the 5th to the late 15th century, marked by feudalism, the rise of Christianity, and the emergence of the modern nation-state.

The Tarantella

A lively, fast Italian folk dance that was traditionally believed to cure the poisonous bite of a tarantula.

Melancholia

A severe form of depression marked by persistent feelings of sadness, hopelessness, and a lack of interest or pleasure in activities, historically viewed as a distinct disorder.

Q6: Predicting the direction of interest rate movements

Q7: When using a constant dollar plan?<br>A) gains

Q8: The actual return on a bond is

Q33: Portfolio revision is the ongoing process of

Q34: Followers of the random walk hypothesis believe

Q50: Which of the following are advantages of

Q52: Rights are long-term call options attached to

Q53: Investors who buy mutual funds that have

Q61: Quick Cement has a return on assets

Q67: If a bond's yield to maturity is