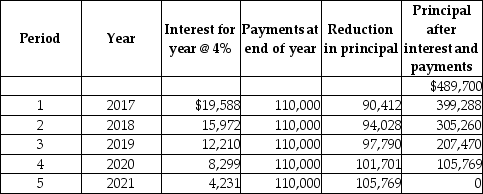

The following amortization schedule is for a lease entered into at the start of fiscal 2017 for an asset that will be useful for 5 years.The company uses straight-line depreciation method.

Required:

Required:

Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31,2019,distinguishing amounts that are current from those that are non-current.

Definitions:

Circumstances

The specific conditions or facts affecting a situation, event, or action that can influence its outcome or the behavior of individuals involved.

Construct Validity

The extent to which a test measures what it claims, or is purported, to be measuring.

Operational Definition

A clear, precise description of a variable in terms of the operations or techniques used to measure or manipulate it in a research study.

Variable

A characteristic, number, or quantity that increases or decreases over time, or takes different values in different situations.

Q7: Hoboken's activities for the year ended December

Q32: Stocks options that trade in the January

Q66: Reuse It Inc.'s (RII)policy is to report

Q70: During its first year of operations,Keen Corp.reported

Q93: A company has income before tax of

Q96: For a commodities contract, the maximum daily

Q100: Why do lessors prefer financing lease treatment

Q101: Writing covered calls protects the writer from

Q105: Which method reflects the tax effect in

Q115: Which statement is true?<br>A) A company should