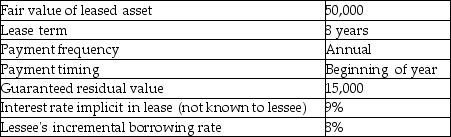

The following are some of the characteristics of an asset available for lease:

Required:

Required:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or finance.

Definitions:

Marginal Tax Rate

The percentage of tax applied to your income for each additional dollar of income, representing the rate at which your last dollar of income is taxed.

Progressive Tax

A taxation system where the tax rate increases as the taxable amount or income increases, often aimed at fairness and equity.

Payroll Taxes

Financial impositions on either employees or the companies that employ them, often gauged as a portion of the wages that employees receive.

Federal Tax Revenue

Federal Tax Revenue is the income collected by the government through various forms of taxes, including income tax, corporate tax, and other taxes, funding government operations and services.

Q5: Use the following information to calculate the

Q5: Complete the following table by giving one

Q24: Which category is used on the cash

Q31: Which of the following is an operating

Q31: During the audit of Keats Island Brewery

Q49: A successful hedge results in a guaranteed

Q50: Which statement is correct about earnings per

Q62: Micky and Donald Corp.was founded on January

Q76: The rate of return on a futures

Q81: Dunder Mae Products has a defined contribution