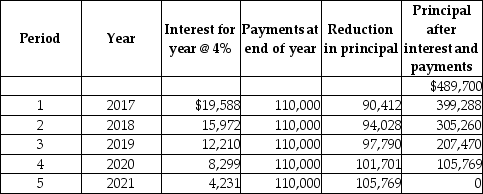

The following amortization schedule is for a lease entered into at the start of fiscal 2017 for an asset that will be useful for 5 years.The company uses straight-line depreciation method.

Required:

Required:

Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31,2019,distinguishing amounts that are current from those that are non-current.

Definitions:

Social Bonding

The process of developing a close, interpersonal relationship between individuals through emotions like love, trust, and cooperation.

Demarcating Territory

Demarcating territory refers to the act of defining and setting boundaries for an area to establish control or ownership by a particular group or individual.

Musicians

Individuals skilled in playing musical instruments, composing, or performing music, often demonstrating specialized auditory and motor skills.

Thicker Frontal

Refers to an increased volume or density in the frontal lobe of the brain, which can be associated with better cognitive functions and control.

Q1: For a call purchased on an organized

Q6: Which method is used under IFRS to

Q22: Which one of the following was the

Q46: What is the deferred tax liability under

Q64: The Company's activities for the year ended

Q72: For the following lease,determine the minimum present

Q90: What is the opening balance of the

Q93: A company has income before tax of

Q98: Dollar-cost averaging plans and constant-dollar plans are

Q99: When shares are repurchased at an amount