Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

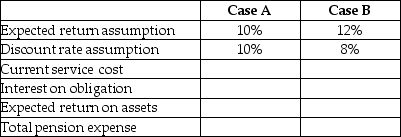

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Predetermined Overhead Rate

A rate calculated before a period begins, used to allocate overhead costs to products or job orders based on a chosen activity base.

Overapplied Overhead

A situation in cost accounting where the allocated overhead for a period exceeds the actual overhead incurred.

Job Order Cost System

This system is a cost accounting method that assigns costs to specific production batches or jobs, making it easier to track the financial resources spent on each job.

Q9: Elville Inc.was incorporated under provincial legislation with

Q33: Give an example of a change in

Q37: For the following lease,determine the minimum present

Q55: Which statement is correct?<br>A) If the reported

Q71: Assume that Millan agrees to purchase US$100,000

Q76: Why do the supporting indicators for lease

Q82: For the year ended December 31,2017,Jovial Productions

Q85: How would exercise of warrants that were

Q92: Under the accrual method,what is the effect

Q105: Which method reflects the tax effect in