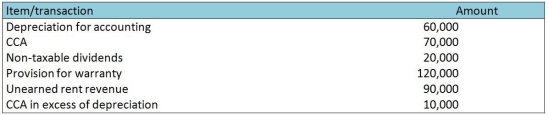

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet.Treat each item independently of the others.Assume a tax rate of 25%.

Definitions:

Evaluation

A planned, ongoing, purposeful activity in which client and health care professionals determine the client’s progress toward goal achievement and the effectiveness of the nursing care plan.

Assessment

A systematic evaluation or analysis of a condition, situation, or education achievement to make informed decisions.

Emergency Assessment

The initial evaluation and management of a patient in a critical condition, aiming to stabilize their vital functions.

Shift Change

The process in workplaces, especially in healthcare, where employees transition between coming on duty and leaving duty at different times.

Q11: Boris Corporation started operations on March 1,2017.It

Q15: Tener Company sponsors a defined contribution pension

Q28: The value of an interest-rate futures contract

Q32: A wheat futures contract is quoted in

Q60: How should warrants on the company's own

Q68: A company facing a 45% tax rate

Q72: Explain the meaning of "par value," "contributed

Q79: Humming Furnishings produces quality household furniture.The company

Q80: Which statement is correct about earnings per

Q98: What adjustment is required to the opening