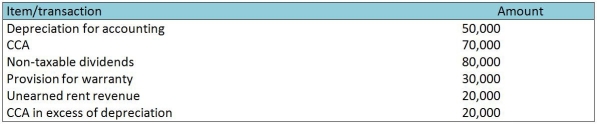

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet.Treat each item independently of the others.Assume a tax rate of 30%.

Definitions:

Mohair Production

The process of producing yarn or fabric from the hair of the Angora goat.

Moral Hazard

The situation where one party is more likely to take risks because another party bears the cost of those risks.

Regulatory Capture

A situation where regulatory agencies become dominated by the industries they were created to regulate, leading to conflicts of interest.

Automobile Safety

Measures and technologies implemented in vehicles to ensure the safety and protection of passengers and pedestrians.

Q17: Which of the following characteristic is required

Q23: Which method must be used under IFRS

Q25: Which statement is correct?<br>A) In a finance

Q52: How much tax expense would be recorded

Q52: Pixel Points Inc.has a single class of

Q61: Assume that a company issued 10,000 shares

Q62: Which of the following is an example

Q102: Dunst Company had the following shareholders' equity

Q105: Briefly describe a compound financial instrument and

Q111: Calculate the share effect on the incremental