The following data represent the differences between accounting and tax income for Seafood Imports Inc.,whose pre-tax accounting income is $650,000 for the year ended December 31.The company's income tax rate is 45%.Additional information relevant to income taxes includes the following.

a.Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b.Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

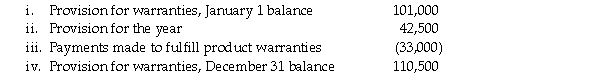

c.In a previous year,the company established a provision for product warranty expense.A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

For tax purposes,only actual amounts paid for warranties are deductible.

d.Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Required:

Prepare the journal entries to record income taxes for Seafood Imports.

Definitions:

Moon-Shaped Face

A facial appearance characterized by rounding of the face, often associated with certain medical conditions or steroid use.

Addison's Disease

A disorder in which the adrenal glands produce insufficient steroid hormones, leading to symptoms like fatigue, muscle weakness, and low blood pressure.

Serum Cortisol

A steroid hormone measured in the blood, which plays a key role in the body's stress response and regulating metabolism.

Skin Darkening

The process by which skin becomes darker in color, often due to exposure to the sun, certain health conditions, or as a side effect of some medications.

Q45: Which of the following statements is true?<br>A)

Q47: Which statement best describes the accounting when

Q48: Which statement about "cash and cash equivalents"

Q49: What is cash management?<br>A) Cash management includes

Q57: A company has a deferred tax liability

Q64: The Company's activities for the year ended

Q67: On January 1,2018,Braeben Inc.granted stock options to

Q74: Compare and contrast the two tax allocation

Q75: Use the following information to calculate the

Q108: Kartik Corporation started operations on March 1,2017.It