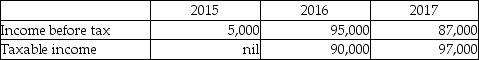

Withering Inc.began operations in 2015.Due to the untimely death of its founder,Edwin Delaney,the company was wound up in 2017.The following table provides information on Withering's income over the three years.

The statutory income tax rate remained at 45% throughout the three years.

The statutory income tax rate remained at 45% throughout the three years.

Required:

a.For each year and for the three years combined,compute the following:

- income tax expense under the taxes payable method;

- the effective tax rate (= tax expense / pre-tax income)under the taxes payable method;

- income tax expense under the accrual method;

- effective tax rate under the accrual method.

b.Briefly comment on any differences between the effective tax rates and the statutory rate of 45%.

Definitions:

Response Prevention

A treatment technique, often used for OCD, where the individual refrains from performing their habitual response to a feared stimulus.

Anorexia Nervosa

An eating disorder characterized by an obsessive fear of gaining weight, leading to restrictive eating habits, severe weight loss, and a distorted body image.

Death Rate

The number of deaths in a given population during a specific period, usually expressed per 1,000 or 100,000 individuals.

Binge Eating Disorder

An eating disorder characterized by recurrent episodes of eating large quantities of food, often quickly and to the point of discomfort.

Q7: Hoboken's activities for the year ended December

Q10: What are three potential outcomes for defaults

Q23: Which statement is correct?<br>A) Basic EPS increases

Q42: Calculate the incremental EPS for the following

Q49: Enterprises need to separate the components of

Q60: Katherina is currently 30 years old and

Q66: Which is a derivative on the company's

Q72: Explain the meaning of "par value," "contributed

Q74: What is a "swap"?<br>A) A contract in

Q110: What is the meaning of "weighted average