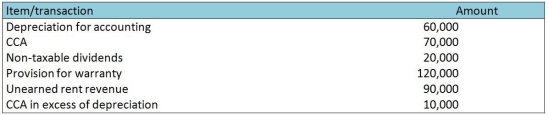

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes,compute the effect of each difference on deferred taxes balances on the balance sheet.Treat each item independently of the others.Assume a tax rate of 25%.

Definitions:

Q13: Which step is not required for hedge

Q25: Capricious Co.Ltd.(Cap)operates a defined benefit pension plan

Q25: Which of the following statements is true?<br>A)

Q51: Businesses that engage in international trade can

Q74: For the following items indicate if they

Q82: Identify if the following investments meet the

Q98: Which statement explains the risk involved in

Q99: Which statement best describes the "proportional method"?<br>A)

Q101: How much tax expense would be recorded

Q109: On January 1,2017,Sheldon Company sold a building