The following data represent the differences between accounting and tax income for Seafood Imports Inc.,whose pre-tax accounting income is $650,000 for the year ended December 31.The company's income tax rate is 45%.Additional information relevant to income taxes includes the following.

a.Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b.Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

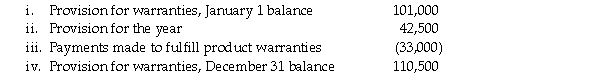

c.In a previous year,the company established a provision for product warranty expense.A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

For tax purposes,only actual amounts paid for warranties are deductible.

d.Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Required:

Prepare the journal entries to record income taxes for Seafood Imports.

Definitions:

Waiting On Someone Else

A situation or status indicating that the progression or completion of a task relies on action from another person.

Tasks Folder

A digital folder designated for storing to-do items, assignments, or tasks in software applications.

To-Do List Window

This is an interface feature within project management or personal productivity software that displays pending tasks or reminders to be completed.

Notes Pane

A section in presentation software that allows the user to enter speaker notes or comments for a specific slide.

Q7: A company has income before tax of

Q11: Use the following information to calculate the

Q27: Which statement is correct?<br>A) Share issuances decrease

Q39: Financial information for Flagstone Inc.'s balance sheet

Q49: Use the facts from #13,above,to determine how

Q65: Which statement is correct about the "two

Q84: A company's activities for the year ended

Q95: On January 1,2018,Gilmore Inc.granted stock options to

Q107: Which of the following is an example

Q118: When will there be a recapture of