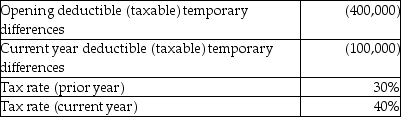

What adjustment is required to the opening deferred taxes as a result of the rate change?

Definitions:

Net Income

The total profit of a company after all expenses, including taxes, have been subtracted from total revenues.

Operating Expenses

Costs associated with running the day-to-day operations of a business, excluding costs related to production or manufacturing.

Advanced Company

A designation often used to describe a business that operates with significant technological advancements or innovative products compared to competitors.

Absorption Costing

Absorption costing is an accounting method that includes all manufacturing costs - direct labor, direct materials, and both variable and fixed manufacturing overhead - in the cost of a product.

Q6: Which statement is correct about offsetting?<br>A) Offsetting

Q8: In the first two years of operations,a

Q22: What is an actuarial gain?<br>A) An unfavourable

Q28: Based on the characteristics provided below,what kind

Q41: The seller of a stock-index future is

Q46: Which statement is correct?<br>A) Equity holders are

Q54: Which is an example of "contributed capital"?<br>A)

Q55: Bailey's Gold Mines Inc.(BGMI)purchases a piece of

Q63: To hedge a bond portfolio, an investor

Q98: Here is an extract of a trial