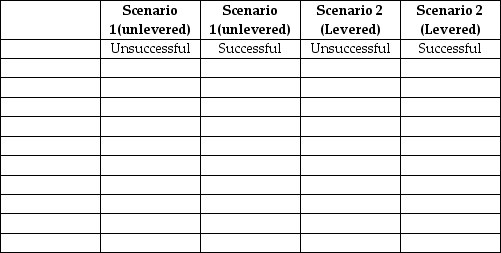

Complete the following chart to illustrate how leverage can increase investors' returns while concurrently exposing them to large losses.

Facts: Calabria Corporation is a new company and has only one asset,its cash of $105,000 from the sale of common shares.

In scenario 1,Calabria invests the $105,000 in a venture that will pay out either $85,000 or $135,000 at the end of one year,depending on the success of the venture.

In scenario 2,Calabria borrows $210,000 at 7% interest and invests $315,000 in the same project outlined in Scenario 1.The payout will be $255,000 ($85,000 × 3)or $405,000 ($135,000 × 3)because it invests three times as much.

Definitions:

Current Profitability

A measure of a company's financial performance in the present or most recent accounting period, indicating the net income earned.

Idle Capacity

Unused production capacity or resources that are not being utilized to their full potential.

Special Discounted Price

A reduced price offered on a product or service, often to stimulate sales, clear inventory, or reward customers.

Opportunity Cost

The potential benefit that is foregone from not following the best alternative action or decision.

Q12: Information technologists are members of the legal

Q29: Explain the difference between "probable," "possible," and

Q30: Lawyers,paralegals,other members of the legal team,and the

Q35: Contemporary smoking gun documents may include emails,text

Q38: Why is it important to distinguish financial

Q40: Calculate the incremental EPS for the following

Q51: Describe how the ethical duty of confidentiality

Q72: Explain the meaning of "par value," "contributed

Q75: Canadian Sea Rides Ltd.issues $8,000,000 of four-year,4%

Q82: Explain why a company should carry back