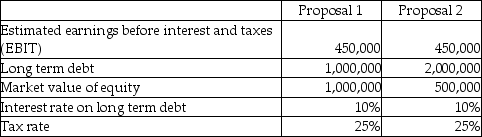

Blue Corp is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Required:

Required:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE = net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (1 - tax rate)).

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Definitions:

Homelessness

The condition of lacking stable, safe, and adequate housing to live in.

Severe Mental Illness

Mental disorders that significantly impact day-to-day functioning, including major depression, schizophrenia, and bipolar disorder.

Drug Problem

Issues arising from the abuse of or addiction to substances, causing significant impairment or distress.

Psychiatrist

A medical doctor specialized in the diagnosis, treatment, and prevention of mental illnesses, including various affective, behavioral, cognitive, and perceptual disorders.

Q3: Which statement is correct?<br>A) Diluted EPS decreases

Q4: When will there be recapture and a

Q10: Non-current debt instruments exchanged for assets are

Q14: The Federal Rules of Civil Procedure have

Q18: Based on the characteristics provided below,what kind

Q24: Which statement is correct about potential ordinary

Q37: _ are companies that provide users access

Q55: Explain how the dividends on cumulative preferred

Q62: The _ is a doctrine that looks

Q65: Which of the following is an example