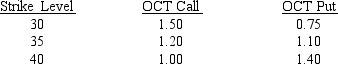

Use the following information on CBOE 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.If you used the OCT 35 option to hedge rising rates,and the yield to maturity (YTM) on 13-week bills is 3.75 percent at the option's expiration,what is the outcome of your hedge?

Definitions:

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life to represent the loss of value over time.

Estate Assets

Assets that belong to a deceased person's estate, including all property and financial accounts, which are managed and distributed according to a will or law.

Q12: Microsoft provides a number of Web-based tutorials

Q16: Electronic office management systems allow access to

Q17: Smith Enterprises stock currently sells for $17.50.A

Q19: Increasingly,judges are embracing the use of _

Q32: The collection phase is the part of

Q34: Steps should be taken to ensure that

Q34: Case management software can now be used

Q42: A put option with a $35 strike

Q47: Which of the following will cause a

Q64: Discovery should be accomplished:<br>A) with court oversight