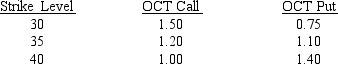

Use the following information on CBOE 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.If you used the OCT 35 option to hedge rising rates,and the yield to maturity (YTM) on 13-week bills is 3.75 percent at the option's expiration,what is the outcome of your hedge?

Definitions:

Credit Customer

A customer who purchases goods or services on credit, agreeing to pay the seller at a later date.

Accounts Receivable

The money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Credit to Cash

A transfer or accounting entry that increases the cash balance while simultaneously increasing a corresponding credit account.

Art Studio

A creative space where artists create, display, and sometimes sell their artworks.

Q7: A wealthy individual who makes private equity

Q21: The current foreign exchange rate is also

Q31: A _ deposition is of a person

Q43: Which piece of legislation was enacted to

Q48: Document review can sometimes be done more

Q53: The goals of the meet and confer

Q54: Al Bert seeks $15 million from a

Q54: If the company has $3,000,000 in funds

Q91: You need to find the price of

Q99: One benefit of external expansion is:<br>A) Acquirers