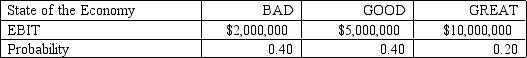

ABC Corporation has a capital structure that consists of $20 million in debt and $40 million in equity. The debt has a coupon rate of 10%, while the industry return on equity is 15%. ABC Corporation is unsure of the state of the economy in the next year. The tax rate facing the company is 40%.

-Refer to ABC Corporation.Given the information in the table,what is the expected earnings per share if the company has 1 million shares outstanding?

Definitions:

Chi-Square Value

A statistical measure used in tests of independence and goodness of fit, indicating how expectations compare to actual observed data.

Degrees of Freedom

Degrees of freedom refer to the number of independent values or quantities that can vary in an analysis without breaking any constraints.

Contingency Table

A data table that displays the frequency distribution of the variables.

Expected Frequency

In statistics, the predicted count of occurrences in a category of a contingency table based on probabilities derived from a theoretical distribution.

Q8: An advantage of the probabilistic approach to

Q10: Given Exhibit 7-3,what is the expected return

Q11: Roxy Internationa is considering retiring a $280

Q22: Big Deal,Inc.wants to grow 30% next year.If

Q25: Refer to SOOIE.What is his after tax

Q32: You are consulting for a firm that

Q49: Suppose Silly Sally,Inc.forecasts an ending cash balance

Q53: A graphical representation of The Trade-Off Model

Q76: Assuming no corporate taxes,what is Bavarian Brewhouse's

Q80: A project generates the following sequence of