Bavarian Brewhouse

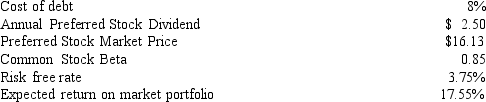

Capital Structure Information for Bavarian Brewhouse

-What is Bavarian Brewhouse's after tax cost of debt,if their marginal tax rate equals 34%?

Definitions:

Plantwide Predetermined Manufacturing Overhead Rate

A single overhead absorption rate calculated for an entire factory, used to allocate manufacturing overhead costs to products.

Machine-Hours

A measure of production output or activity based on the total number of hours machines are operated.

Manufacturing Overhead

All manufacturing costs not directly assignable to specific products. This includes costs related to indirect materials, indirect labor, and factory-related expenses.

Estimated Total

A projection or approximation of the total value, quantity, or extent of something.

Q11: If you were to purchase an asset

Q13: You are considering buying carpet for your

Q22: What is the payback period of the

Q35: Markus Needman,Inc.just paid a 30% stock dividend

Q40: You have a $1 million capital budget

Q53: An instrument that gives the holder the

Q69: Which of the following is considered a

Q70: Which answer describes an analysis of what

Q82: If you are a stock trader and

Q89: What is the best case scenario break