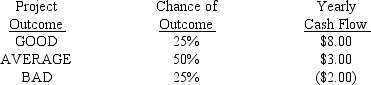

A firm is considering investing $10 million today to start a new product line.The future of the project is unclear however and depends on the state of the economy.The project will last 5 years.The yearly cash flows for the project are shown below for the different states of the economy.What is the expected NPV for the project if the cost of capital is 12%?

Definitions:

Q16: A decrease in accounts receivable will _

Q32: Refer to Exhibit 14-1.If you were to

Q37: Financial leverage:<br>A) results when a firm finances

Q41: An increase in which of the following

Q44: Which statement correctly describes proposition I of

Q44: Emma International has earnings per share of

Q76: Refer to Tompson Manufacturing.Suppose the hurdle rate

Q87: A firm's weighted average cost of capital

Q89: Consider the cash receipts projections of Roxy

Q101: Calculate Bavarian Brew's earnings per share after