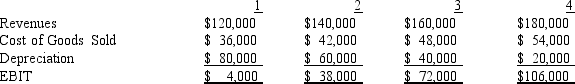

Exhibit 9-2

The following data are projected for a possible investment project:

-Refer to Exhibit 9-2.The project requires an initial investment of $300,000 on equipment.Working capital is anticipated to be variable at 10% of revenues; the working capital investment must be made at the beginning of each period,and will be recovered in full at the end of year 4.Equipment will be sold at its book value at the end of year 4.The tax rate is 40%.

What is the net cash flow to the firm in year 4?

Definitions:

Market Price

The market rate at which an asset or service is currently available for buying or selling.

Total Allowable Catch (TAC)

A fishery management tool that sets a limit on the amount of a fish species that can be caught over a specified period to ensure sustainability.

Individual Transferable Quota (ITQ)

A system that allocates a certain amount of catch or production rights to individuals who can then trade these rights among themselves.

Property Rights

The legal rights to possess, use, and dispose of assets, including the right to exclude others from using them.

Q30: A standardized measure of risk is:<br>A) alpha<br>B)

Q44: Which of the following would most likely

Q64: NPV and IRR may give conflicting decisions

Q82: Static Utility Company anticipates its revenues,and consequently

Q83: Purple Bell Butter Company increased its sales

Q87: WeOweYou,Inc.has a 12-year bond outstanding that makes

Q90: If any project is to have a

Q93: What are Bavarian Brew's earnings per share

Q95: Refer to Bavarian Brew Bond.What are the

Q96: The option to make additional investments should