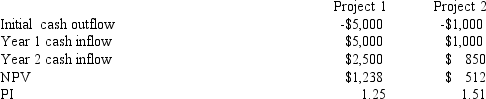

You are provided with the following data on two mutually exclusive projects.The cost of capital is 15%.

Which project should you accept? What is the problem that you should be concerned with in making this decision?

Definitions:

Cash Inflows

The total amount of money being transferred into a company, typically from operations, financing, or investing activities.

Net Cash Inflows

The total amount of cash received by a company during a specific period, minus the total amount of cash outflows.

Payback Period

The length of time required to recover the cost of an investment, calculated by dividing the initial investment by the annual cash inflow.

Discount Rate

The interest rate used to discount future cash flows to their present value, reflecting the time value of money and risk.

Q22: Louis International needs $100 Million in new

Q24: Equal,Inc.is financed with equal portions of debt

Q34: Refer to Kennesaw Steel Corporation.What is the

Q50: Zeb Corporation just paid a dividend of

Q56: The risk-free rate is 5% and the

Q56: One method of preventing or reducing the

Q62: Refer to Bavarian Brew Bond.What are the

Q79: Roxy Bonds will mature in 16 years,the

Q81: Nuclear Widgets has a current cost of

Q93: Emma International needs $250 Million in new