Multiple Choice

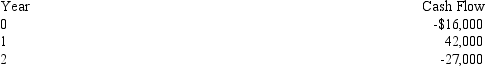

Consider a project with the following cash flows.

What's the IRR of the project? If a firm's cost of capital is 15%,should the firm accept the project?

Definitions:

Related Questions

Q6: Refer to Big Diesel Incorporated.If we assume

Q17: If ABC's stock price closes at $46.75

Q19: A portfolio consists 20% of a risk-free

Q28: An investor has $10,000 invested in Treasury

Q39: Roxy International needs $200 Million in new

Q44: Usually,only the riskiest type of firms will

Q48: A mutual fund that adopts a passive

Q52: A machine costs $3 million and has

Q70: Zeta Corp has an ROE of 15%;

Q111: You have the choice between investing in